Note: This post may contain affiliate links which means if you click on a link and purchase an item, we will receive an affiliate commission at no extra cost to you.

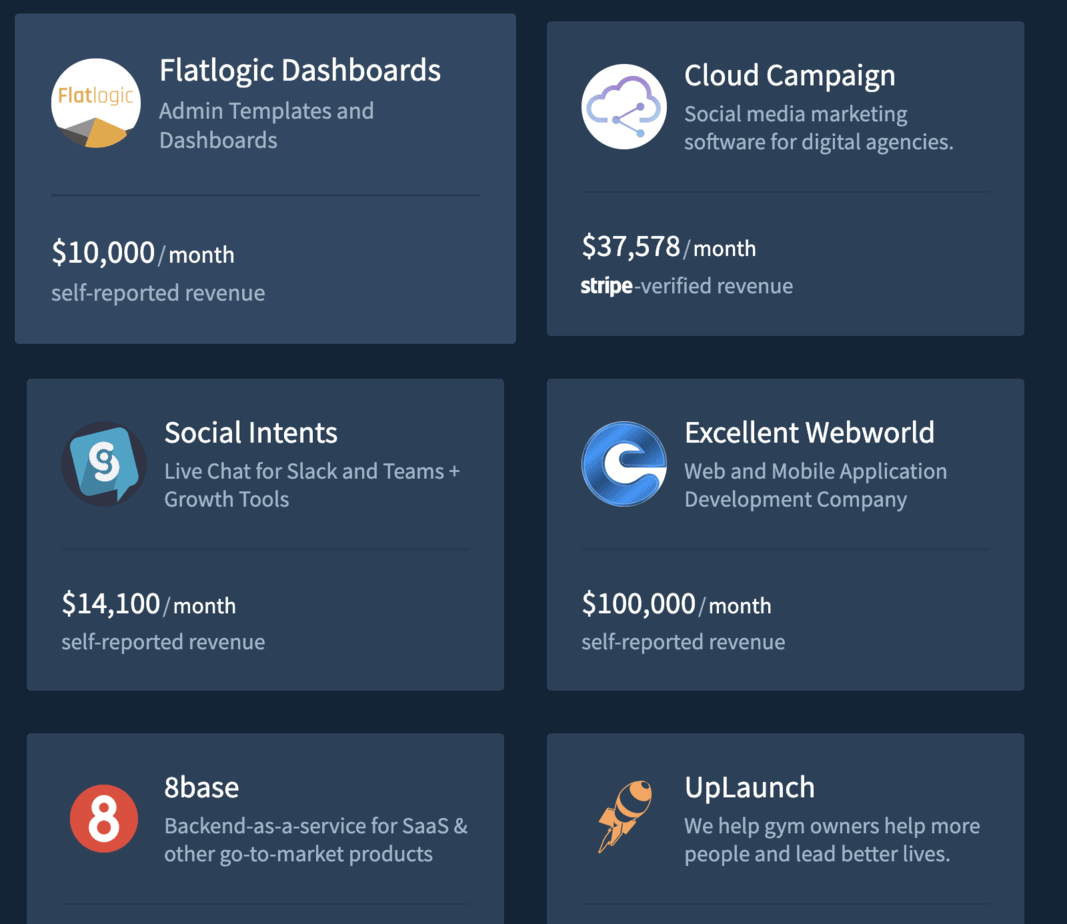

If you haven’t read our list of the fastest-growing remote startups, definitely check it out.

Why join a fast-growing startup?

“If you’re offered a seat on a rocket ship, get on, don’t ask what seat.” -Sheryl Sandberg, COO of Facebook (the full story)

“Your choice of company trumps everything else. It’s more important than your job title, your pay or your responsibilities.” -Andy Rachleff, CEO of Wealthfront & Former Partner at Benchmark Capital

“If you join a company, my general advice is to join a company on a breakout trajectory.” -Sam Altman, former Y Combintor President (source: BreakoutList)

- Career Upside

- An abundance of advancement and promotion opportunities because the company is growing quickly

- If the company becomes successful, you’ll get more credit than you deserve and people will want to hire or fund you

- Learning Upside

- In a fast-growing, dynamic company, you’ll be exposed to a lot of smart people and highly dynamic environments and learning experiences

- Financial Upside

- Equity in a fast-growing company is one of the best low risk, high reward time investments

- Networking Upside

- “The networks people build early in their careers at hypergrowth companies are often their most important professional networks ever…the canonical example of this is the PayPal Mafia” -Sam Altman

For more about the logic behind why you should join a fast-growing company, I highly recommend reading Andy Rachleff’s post about this.

How to evaluate a startup that you’re considering joining

1. How fast is the company growing?

A) Digital & Business Metrics

You can look at Alexa.com statistics to see how much the company’s web traffic has grown in the last 12 months. The best data points will come directly from the company though.

You should definitely ask about revenue growth rates and trajectory.

B) Employee Growth

You can search for the company at Remote Work Hub to see how quickly the company’s headcount has been growing.

If a company is scaling quickly then it’s usually a strong indicator that things are going well!

2) How strong is the leadership team?

This is especially important for very small companies because the future trajectory of the company will have a high correlation with the abilities of the founding team.

You can research the team on LinkedIn and ideally, you’ll get a chance to speak with some of the founders during your interview process.

3) How much has the company raised and who are the investors?

Fundraising is one of the most valuable and telling indicators of a company’s trajectory. If a company has raised money from some of the best startup investors in the world (or the smartest investors in their specific industry) then it’s a fantastic sign.

Because the best investors in the world tend to have their pick of the best deals, joining companies backed by these investors is a safer bet.

If you’re looking to understand who the best investors in the world are, read these two resources: Top 100 VCs and Unicorn Hunters.

Also, keep in mind that startups normally raise 12-18 months’ worth of money, so be mindful of when they last raised. You want to avoid joining a company that’s running out of money. It’s a delicate subject but you can always ask the company about their fundraising status.

4) Ask the smartest startup person that you know for their opinion

When in doubt, ask the smartest startup person that you know what they think about the companies that you’re evaluating. If you don’t know smart startup people then cold email a venture capitalist and politely ask for a quick evaluation (this is a good excuse to network as well!).

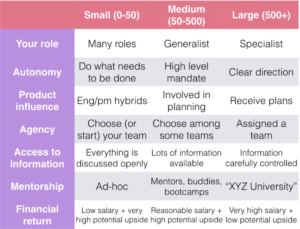

Understanding Startup Size & Stage Pros/Cons When Job Searching

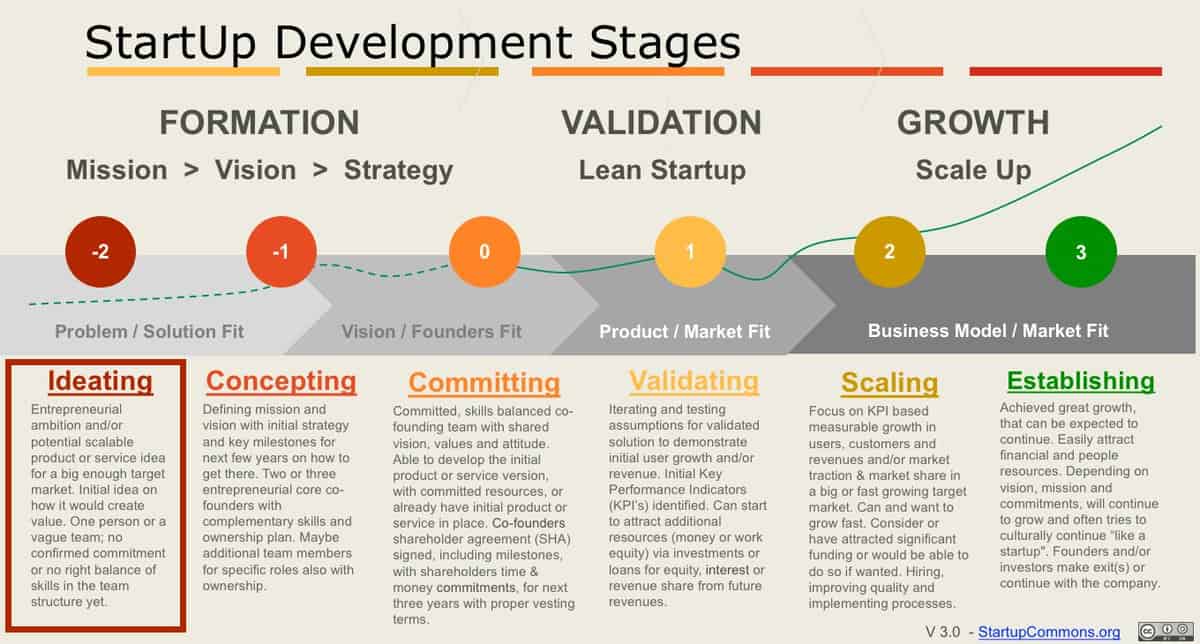

1. Early Stage: Pre-Seed, Seed & Series A Funding; ~<60 People; Ideating, Concepting, Committing, and Validating

- Pros:

- Generalist w/ Ownership: You’ll likely be in a generalist and high ownership role where you’ll get to make a lot of strategic decisions

- Founder Practice: You’ll witness the formation of a new business first-hand (helpful if you want to start your own business in the future)

- Cons:

- Risky: You have founder level (or close to founder level) risk without founder level upside

- If you join a company before it has product-market fit, then there’s usually a lot of risk

- Pay Cut: You’ll likely have to take a pay cut in exchange for equity

- Risky: You have founder level (or close to founder level) risk without founder level upside

2. Growth Stage: Series B & C Funding, ~60-300 People, Scaling (Why Growth Stage is Recommended)

Tip: The larger the company’s size, the less upward mobility there is. The ideal situation is a small company with a huge amount of funding and growth.

- Pros:

- This is the rocketship stage: much less risky, yet still growing very quickly

- Significant financial upside, career upside, and learning upside

- Cons:

- Pay Cut: You’ll likely have to take a pay cut in exchange for equity

- Because the company is bigger, there isn’t as much upward mobility as early-stage startups (but you’ll still have a lot if you perform well and the company grows!)

3. Late Stage: Series C, D, etc. Funding, ~150+ People, Establishing

- Pros:

- Established, very low-risk company that likely pays well

- You’ll still get many startup benefits (smart people, innovative culture, etc.) without startup level risk

- Cons:

- The company’s org chart will be very established so there are unlikely to be rapid advancement opportunities

- Your role will be much more specialized due to the company’s maturity

Bonus Resources:

The 15 Crucial Questions About Stock Options

Leave a Reply

View Comments