Note: This post may contain affiliate links which means if you click on a link and purchase an item, we will receive an affiliate commission at no extra cost to you.

The path to financial independence and early retirement (FIRE) is much simpler than most people realize. In this comprehensive guide, I’m going to cover the fastest ways to retire and the best resources to learn more about this.

Why would you want to financially retire early?

This may be a rhetorical question for most but I’ll answer it anyway.

The reason is freedom. If you don’t have to work for money, then it provides you with the ultimate freedom to chase your passions, spend time doing things that make you happy, and live in a meaningful way.

My personal goal wasn’t to stop working, it was to make enough money so that I would never have to think about money again.

As a result of financially retiring, I’m now able to purely focus on creating positive change in the world by creating content to help people improve their lives and by working on climate change-related endeavors. I’m doing that via this site (about this site) and via my other ventures.

For you, you may want to financially retire early because you don’t know how to make money with your true passion, so that you can sit on a beach, or so that you can spend more time with your kids.

Or maybe you want to reach retirement because you want to own your time and have the freedom to do whatever the hell you want. Any reason is a good reason in my book!

Table of Contents

My Early Retirement Story in a Nutshell

I’m an American who quit my job and left the U.S. in early 2017 (when I was 25) to travel the world while building passive income internet businesses.

It took me ~2.5 years to reach financial retirement. Since starting my journey 2.5 years ago:

- I decreased my yearly expenses by 2.5x because I now live a very frugal/inexpensive lifestyle while spending most of my time living in developing countries

- I increased my yearly income by 2.5x via digital passive income businesses that now generate an income equal to ~9x my yearly expenses (meaning I’m now able to save ~85% of my after-tax earnings).

- While I haven’t officially reached my financial retirement number, the ongoing passive income I’ve created means in the next 2-3 years, I’ll easily reach my retirement goal without doing any additional work.

Note: Avoiding debt is critical to retiring early and I had the privilege of graduating from college without debt which is obviously a huge advantage. You can read about why I’m unlikely to send my kids to college and why I think it’s a waste of time and money.

Retirement Principles To Understand

1. You’ve reached retirement when your yearly expenses equal 4% of your total savings

If your living expenses are $40,000/year, you would need $1,000,000 in savings to retire.

Why? The goal is to never have to touch your principal amount of savings after you retire and 4% is the widely accepted safe withdrawal rate. You can expect a yearly return of ~7-10% on your savings via investments, you’ll lose ~3% to inflation, and thus you’ll be leftover with a safe withdrawable increase of ~4% yearly.

2. You can calculate how many years it will take you to financially retire by looking at the percentage of after-tax income that you’re saving

To retire in four years, you would need to save 85% of your after-tax income. Use this early retirement calculator to do a custom analysis of how long it will take you to retire based on your savings rate and total current savings.

How To Financially Retire At A Young Age

1. Live Frugally

“By sowing frugality, we reap liberty, a golden harvest.” -Agesilaus

The most important principle of early retirement is getting comfortable with living cheaply. Most people fall into the trap of income inflation (the more money they make, the more they spend). This is precisely what you want to avoid if you’re looking to retire early.

If you’re already making a significant income then you can achieve early retirement just by living frugally.

Related post: How To Become a Minimalist (And Why Minimalism Makes You Happier)

My personal strategy is geographic arbitrage: living in developing countries while running online businesses that make American money. For me, it’s more than just saving money though, I prefer life abroad and you can live a phenomenal lifestyle at 3-4x cheaper than the cost of living in the U.S.

Extra Tip: One hack is to make money in an expensive place (i.e. San Francisco) and then retire somewhere much cheaper (i.e. Chiang Mai, Thailand). When I lived in Thailand, I met a decent number of American and Australian retirees who were living fairly lavishly on ~$18k/year.

2. Increase Your Income

While living frugally is the most important aspect of retiring early, increasing your income is the other way to accelerate the process.

Here are some strategies for increasing your income:

A) Negotiate A Raise

This is a simple way to earn more.

- How to negotiate a raise with ANY job (+ exact scripts)

- Step 1: Track the results you get at your job

- Step 2: Show your boss your results & ask what you can improve

- Step 3: Schedule a meeting with your boss to discuss compensation and ways you can add value

- Step 4: Practice negotiating a raise with a friend before the meeting with your boss

B) Get A Higher Paying Job

Getting a higher paying job is one of the most straightforward paths to increase your income.

- Find and apply for a better paying job

- How to Get a Better Job (Guide)

- Figure out what you want out of your next job

- Prepare your resume, LinkedIn and cover letter

- Hunt and apply for opportunities

- Reach out to decision-makers directly

- Nail the interview

- Negotiate your salary

- Secondary Guide: The Ultimate Guide To Landing Your Dream Job

- How to Get a Better Job (Guide)

- Move to a new city to obtain a better paying job

- Placement is a service that will help you get a higher paying job in a new city

- Get a remote job that pays you a similar salary and move to a cheaper city/country

- Level up your skills and switch to a higher-paying career in ~3 months

- There’s a rise in skill and career-based education where companies will help you learn skills to dramatically increase your earning potential.

- We combed through hundreds of options to build these recommendations and we only recommend companies that have job placement guarantees because then their incentive is to make sure you get a job, not just to take your money.

- Software Engineering (Average Salary of $67k)

- Design (Average Salary of $65k)

- Data Science ($106k average) & Data Analytics ($80k average)

- Product Management ($85k average)

- Recommended School (Product School) – No job placement guarantee

- Software Sales ($82k average)

- Digital Marketing ($67k average)

C) Start A Business

Running your own business is the ultimate freedom but it’s also the most challenging path. Here are the best resources if you’re interested in starting a digital business!

Read our post on how to make money online for a more in-depth breakdown of the different types of digital businesses you can start.

- General (Read This First)

- Starting An Online Business: The Ultimate Guide for 2020 (from Hustlr)

- An epic guide that covers affiliate marketing, private label eCommerce, dropshipping, freelancing/agencies, and online courses

- Starting An Online Business: The Ultimate Guide for 2020 (from Hustlr)

- Freelancing, Consulting, or Coaching

- The easiest and fastest way to monetize your existing knowledge/skills.

- The Complete Guide to Becoming an In-Demand, Well-Paid Consultant, Coach or Freelancer

- Online Courses (selling information products)

- High margin, scalable way to monetize your knowledge/skills.

- The Ultimate Guide on How To Start An Online Course Business

- Content/Affiliate Website (starting a blog/website with information)

- Lower margin, scalable way to monetize your knowledge/skills.

- How To Create A Profitable Affiliate Site (+50 Examples)

- How To Start A Niche Website That Can Make $3k/month

- Amazon FBA Businesses (selling products on Amazon)

- Hyped but competitive and requires capital to scale.

- The Best Guide To Selling On Amazon FBA (Written Guide or Video Guide)

- eCommerce & Dropshipping (selling your own products or someone else’s products online)

- Dropshipping has become increasingly competitive but eCommerce remains a great opportunity and there are still many opportunities to make money within dropshipping.

- eCommerce: The Ultimate Guide To Starting And Scaling An Ecommerce Business

- Dropshipping: The Ultimate Guide To Dropshipping on Shopify

- General Startup Philosophy

- How To Start A Startup by Y Combinator

- This is more tailored towards high growth, venture-backed businesses (as opposed to the cashflow type businesses we’ve listed above). But there are lots of incredible lessons in here.

- Features some of the best founders and investors in the world.

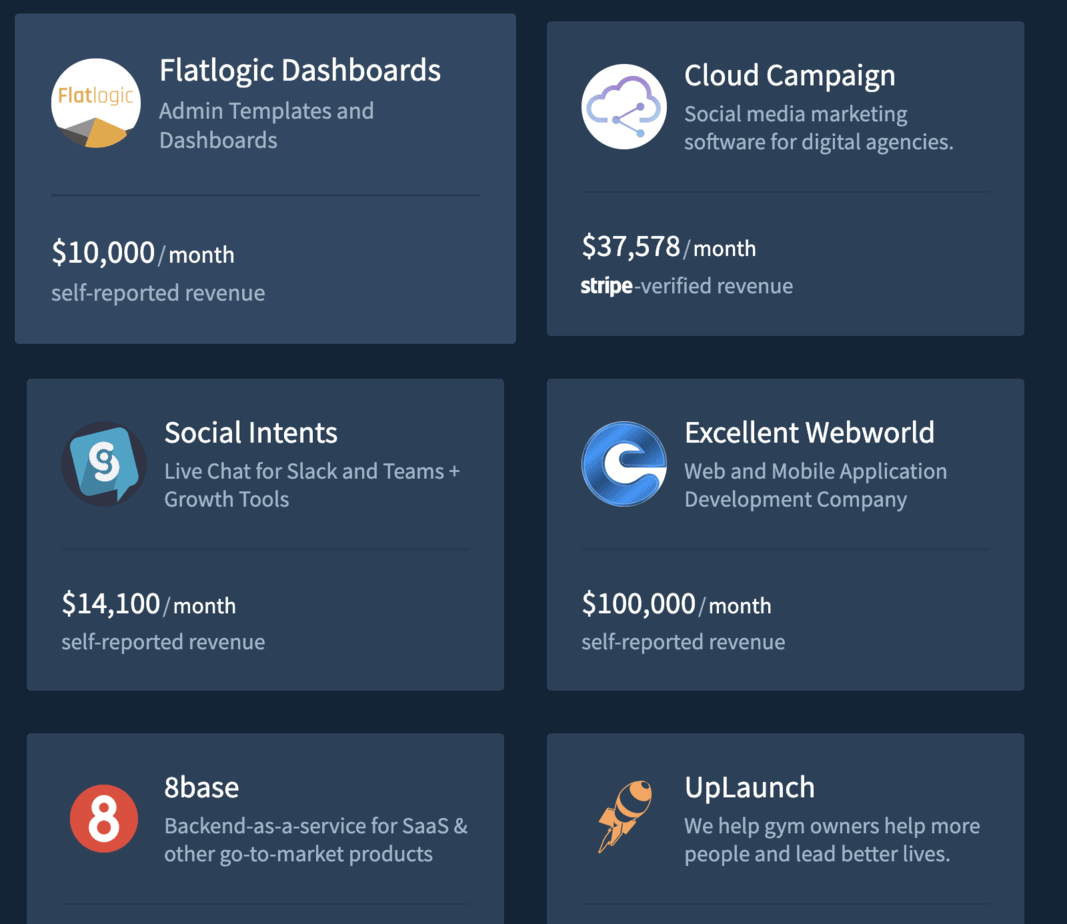

Related: Examples of 250+ businesses started with <$5k that have profited $100k+

D) Start A Side Project (That Makes Money)

The most important thing here is to not waste your time on something that isn’t passive or doesn’t have significant earning potential (i.e. can grow into a full-on business).

It’s easy to get distracted with a side hobby instead of focusing on earning more money at your primary job.

- 17 Ways To Make Extra Income Even With A Full-Time Job

- Become an Airbnb host

- Become a freelancer or consultant in an area of expertise

- How To Make Money On The Side (I Will Teach You To Be Rich)

- What skills do you already have? What do your friends call you for advice on? What kind of sites do you read?

- Turn your knowledge into a freelance, coaching, or consulting business

- Your pitch: “I can help you (some service) so that you can (some benefit).”

3. Invest Your Savings Wisely

Note: I’m not a professional financial advisor and this isn’t professional investing advice.

“My wealth has come from a combination of living in America, some lucky genes, and compound interest.” -Warren Buffett

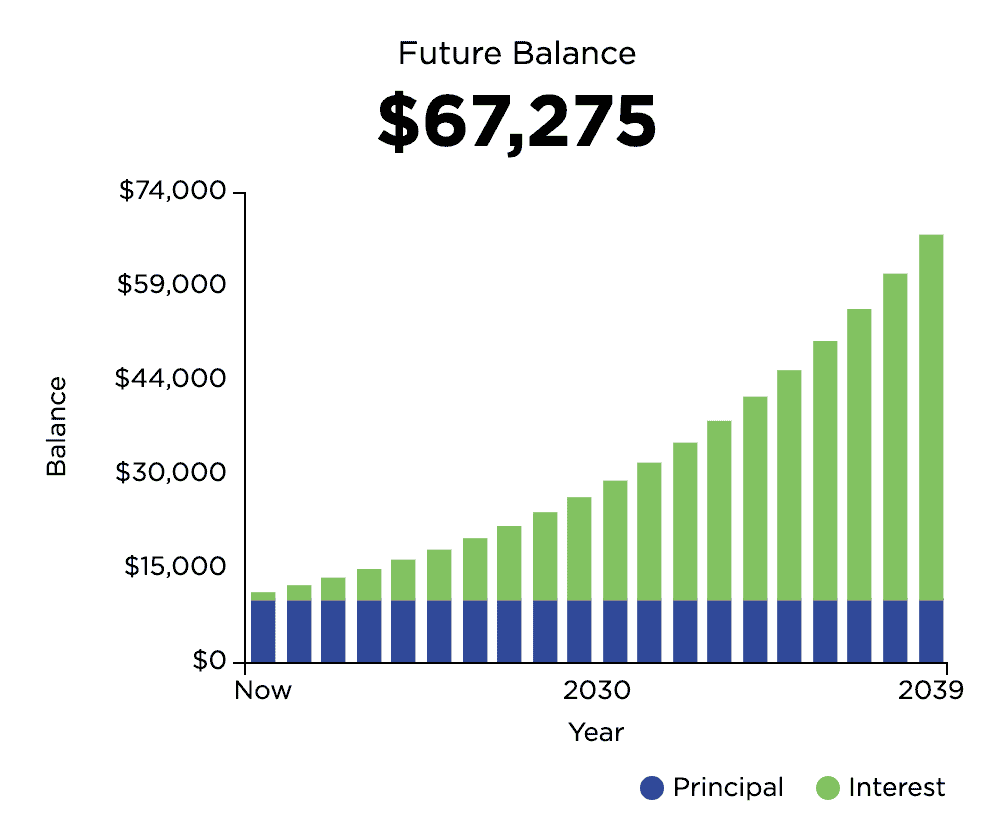

Saving and investing early is critical because your investments will compound over time. What does this mean exactly? It means that if you invest $10,000 today and that investment returns 10% each year, then in 20 years you’ll have $67,275.

While people have varying opinions, I’m a firm believer in following Warren Buffett’s advice which is to invest your savings in ETFs (low fee, diversified portfolios of high performing stocks).

Why you should avoid stock picking: Even the Experts Can’t Beat the Market. Why Would You?

I recommend using Betterment or Wealthfront to automate this process and make it hassle-free. They are low-fee “robo-advisors” that each manage $15B+ in assets. They invest your money in diversified ETFs and automatically re-balance your portfolio for a fee of only 0.25% each year.

Extra reading: How Warren Buffett bet (and won!) $1M that low-cost index funds would outperform stock pickers

Best Learning Resources & Tools:

- General

- The Shockingly Simple Math Behind Early Retirement (+ 30 Minute Video On Retiring Early)

- “The most important thing to note is that cutting your spending rate is much more powerful than increasing your income. The reason is that every permanent drop in your spending has a double effect:

- it increases the amount of money you have leftover to save each month

- and it permanently decreases the amount you’ll need every month for the rest of your life”

- “At a certain level of income (which I feel is around $100,000 per person per year), the time to financial independence becomes so short that it becomes increasingly futile to earn more”

- “The most important thing to note is that cutting your spending rate is much more powerful than increasing your income. The reason is that every permanent drop in your spending has a double effect:

- How Anyone Can Retire Early In 10 Years (Or Less!)

- The math behind retiring early is simple

- Three paths to financial independence: frugality, entrepreneurship, or real estate

- Most people don’t have the discipline to be able to retire early

- The Ten Pillars of Financial Independence

- Low-cost index fund investing

- Low-cost housing

- College hacking

- Book: Your Money or Your Life by Vicki Robin (Book Summary)

- Savings equal freedom, yet endless debt has become normal in our society.

- We all know that “money can’t buy happiness,” but what do our actions say?

- Money is life energy.

- Tool: Track your spending for free with Mint.com

- The Shockingly Simple Math Behind Early Retirement (+ 30 Minute Video On Retiring Early)

- Buying vs. Renting (Homes/Apartments)

- The Return On Rent Is Always Negative 100%: Here’s How To Live For Free (an argument for buying, not renting).

- The return on rent is always -100%

- Buying a home is an easier investment than buying stocks

- Your property will appreciate in value while you sleep

- Why Your House Is A Terrible Investment (an argument for renting, not buying)

- Buying a home is an ongoing financial drain, it’s an illiquid investment, it’s complex to buy or sell, it forces you to live in one place, and isn’t a diversified strategy

- The Return On Rent Is Always Negative 100%: Here’s How To Live For Free (an argument for buying, not renting).

- Get Out of Debt

- 13 Best Ways To Get Out of Debt Fast

- You must confront your debt by calculating your debt ratio.

- Permanently change the behaviors that got you into debt.

- You must make enough money to repay the debt.

- Pay more than the minimum

- Consolidate and refinance your debt

- 13 Best Ways To Get Out of Debt Fast

- Others

Leave a Reply

View Comments